- Stat Significant

- Posts

- 'Civil War' and the Rise of A24: A Statistical Analysis

'Civil War' and the Rise of A24: A Statistical Analysis

How A24 went from indie studio to mainstream entertainment brand.

Everything Everywhere All at Once (2022). Credit: A24.

Intro: A24 Has Hit the Mainstream

This past weekend, A24's Civil War premiered to $25.7M in ticket sales, topping the box office and marking a key milestone in the indie studio's rise to mainstream prominence. After a decade of producing low-budget critical darlings like Past Lives, The Zone of Interest, Moonlight, and Everything Everywhere All at Once, Hollywood's hipster favorite has set its sights on grander productions and higher grosses, with Civil War's $50M budget representing its boldest investment to date.

In a film industry dominated by legacy franchises and never-ending sequels, A24 exists as a prominent outlier, almost single-handedly supporting a (surprisingly profitable) niche of artistically-minded low-budget theatrical releases. With each crossover hit, the indie studio expands its devoted fanbase—a rarity given that 99.99% of people don't care about production companies. In just under a decade, this Hollywood upstart has cornered the arthouse film market, consistently earning Oscar nominations and captivating the hearts and minds of Letterboxd film nerds.

So today, we'll explore A24's unique business model, the company's ten-year ascension into the mainstream, and the indie standout's murky future.

A24's Highly Profitable Niche

A24’s logo. Credit: A24.

Film industry veteran Daniel Katz was traveling along an Italian highway when he conceived of a movie studio built around director independence and projects with a "distinctive point of view." Katz and his co-founders ultimately crafted a highly unique entertainment brand "more akin to a tech company than a classic studio," with a flat organizational structure, employee equity, and an explicit goal of providing "the freedom to ideate and experiment" for talented filmmakers. Katz named the company A24 after the Italian motorway he was driving on when he first conceptualized the venture.

Since the company's founding in 2012, A24 has served as a bastion for old-school indie filmmaking, producing smaller-scale, critically acclaimed works like Uncut Gems, The Iron Claw, Midsommar, and Lady Bird.

A collection of A24 classics. Credit: A24.

The studio releases anywhere from ten to fourteen films a year, with most works quickly fading into obscurity while a select few capture the zeitgeist. Like all Hollywood production companies, A24's success is marked by a handful of standouts amidst a sea of low-achievers.

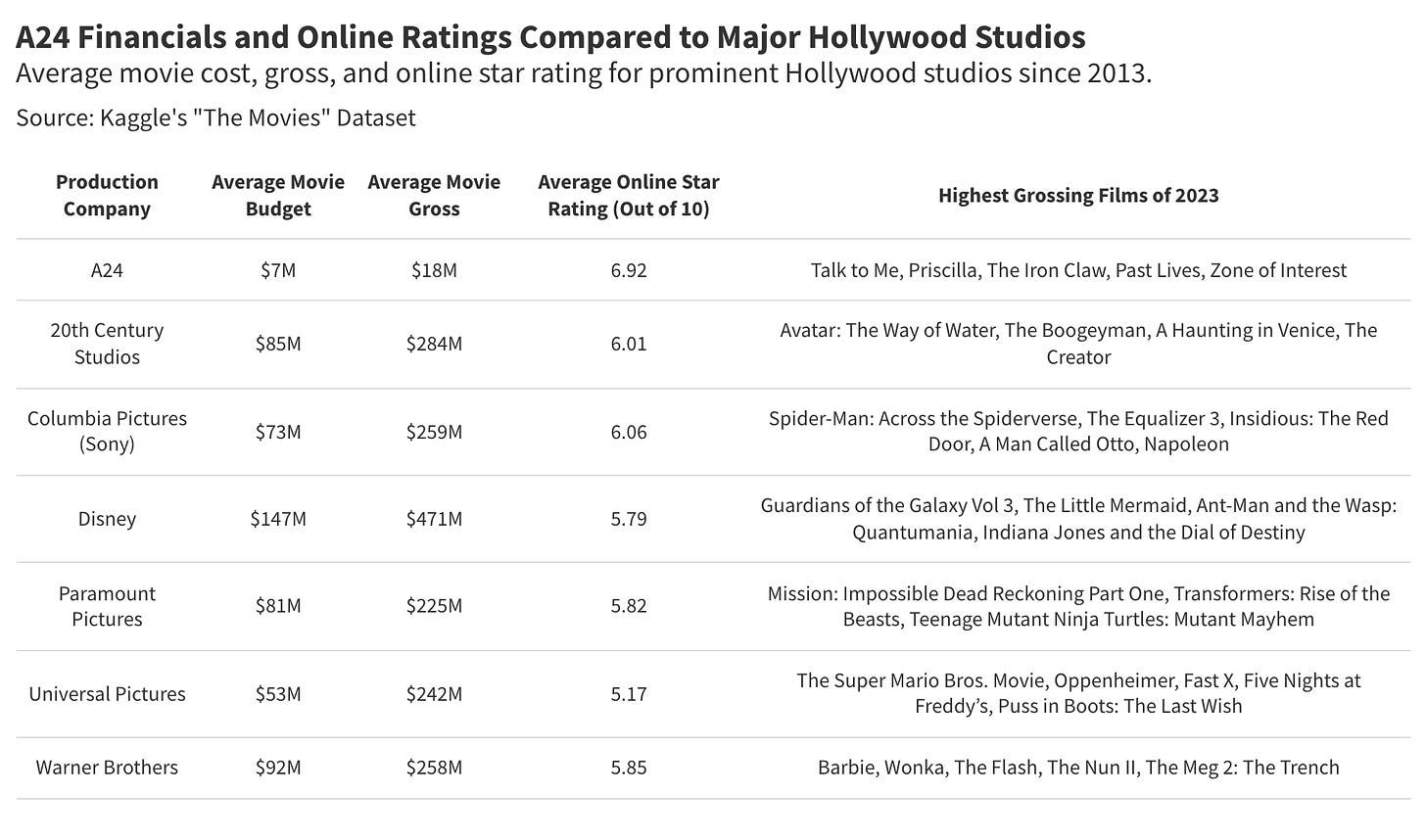

At first glance, these totals may seem low, especially compared to Disney and Paramount projects that regularly target more than $200M in sales. But A24 doesn't need blockbuster returns to generate a profit. When we compare the economic profile of an A24 release to that of a major studio, we observe radical differences in average project cost, gross, and online star rating.

Note the sheer number of colons, numbers, and Roman numerals in the non-A24 titles—a testament to Hollywood's franchise-laden landscape.

In a given year, A24 produces fourteen ~$7M films instead of one $100M movie, diversifying its bets and reaping significant returns from its crossover hits. These smaller-scale works target adult audiences—a sharp departure from typical studio blockbusters that aim for PG or PG-13 ratings to maintain universal appeal.

Of A24's 25 highest-grossing projects, 92% received an R rating.

Across the rest of the film industry, around 51% of movies typically receive an R rating.

Ultimately, A24 is filling a gap within the entertainment market, serving an adult demographic long abandoned by the studio system. Twenty years ago, a project like Lost in Translation or Brokeback Mountain would come from a major Hollywood player like Universal Studios (or one of its subsidiaries)—today, these films go largely unmade or have migrated to smaller outfits like A24 and Neon. Hit after hit, the studio has grown its footprint, transforming from indie upstart to mainstream entertainment brand.

Need Help with a Data Project?

Enjoying the article thus far and want to chat about data and statistics? Need help with a data or research project? Well, you’re in luck because Stat Significant offers data science and data journalism consulting services. Reach out if you’d like to learn more.

Email [email protected]

A24's Journey into the Mainstream

The 2023 Academy Awards proved a landmark moment for A24. The studio's zany metaverse-centric Everything Everywhere All at Once dominated The Oscars, winning seven awards, including Best Picture, after taking in over $144M at the box office. Hollywood's indie standout would build upon this success in the back half of 2023, with films like Past Lives and The Zone of Interest earning triple their budgets while also picking up nominations for Best Picture. After a decade of relative obscurity, A24 is no longer an underdog.

Over the past ten years, A24 has gradually increased its average gross per project and total annual box office returns.

This graphic excludes data from 2020 and 2021, when moviegoing was heavily disrupted by the pandemic.

Much of A24's success stems from partnerships with innovative auteurs, with films like Everything Everywhere All at Once, Uncut Gems, Midsommar, The Zone of Interest, Priscilla, and now Civil War stemming from repeat collaborations with the same directors. Courting marquee filmmakers ensures a certain standard of excellence for each project while simultaneously capturing that filmmaker's fanbase. Sure, a name-brand auteur covets significantly fewer moviegoers than a comic book character or children's doll. Still, the $2M to $5M in incremental ticket sales stemming from Ari Aster's, Jonathan Glazer's, or Sofia Coppola's fanbase are enough to push an A24 film to profitability (given their low cost).

A24 has built a distinctive brand through creative partnerships and its rejection of Hollywood monoculture. In recent years, the studio has begun to capitalize on this name recognition, launching a subscription membership for fans (called AAA24), creating an A24 app, selling state-of-the-art merch, and auctioning off props from its films (including the hot dog fingers from Everything Everywhere All At Once). At first glance, a movie studio directly monetizing its brand sounds like overreach—but A24 is no ordinary studio.

Google search volumes for "A24" recently surpassed that of much larger Hollywood players like Paramount and Warner Bros.—evidence of the company's outsized cultural reach.

If you're a fan of the Fast & the Furious series, you're unlikely to care about Universal Studios—enjoying this movie will not endear you to their future work. Somehow, A24 has foregrounded itself, establishing a strong link between the studio and its films and growing brand affinity with each successive hit—to the point where someone would conceivably buy A24 socks (for $20!).

A24 Socks. Credit: A24.

In my case, I'd like to buy A24's $36 Marcel the Shell with Shoes On collector's edition 4k Blu-ray—which is way too much money to pay for a near-extinct media format and a movie about a talking shell (who wears shoes!).

Marcel the Shell Blu-ray. Credit: A24.

On the other hand, I think this merch looks cool and I like A24—a testament to the power of their brand and my poor decision-making abilities.

Ultimately, A24 has proven a unique case study, building a successful entertainment brand by capitalizing on niche cultural tastes. But what happens when an upstart exhausts the potential of a niche? A24 recently raised $225M in private equity financing, which means they're now accountable to these investors and beholden to perpetual bottom-line growth. Can A24 go mainstream without becoming mainstream?

Final Thoughts: Is A24 "Doing God's Work"?

Credit: A24.

This past year, my wife and I went to a food hall in what could otherwise be considered a mundane dinner outing. But alas, we were seated next to an extremely loud and oblivious person who was effectively screaming into her phone for what felt like seven hours. At one point, the father of a family of four asked her to keep it down, but the phone-screamer persevered, barely acknowledging his request and seemingly amping up the volume of her voice. The content of this phone call was so ridiculous that my wife and I began keeping notes of what was said. A few months ago, we dug up this keepsake, and I was struck by one phone-screamer comment that I actually agreed with: "A24 is doing God's work."

Now, I'm not sure if God is particularly invested in the artistic integrity of the film industry, but I know that me and other movie nerds are. Certain brands have come to symbolize a resistance to the growing consolidation, standardization, and franchise-ation of the entertainment industry: the Criterion Collection, Letterboxd, Mubi, the Cannes Film Festival, Neon, and, of course, A24. These ventures focus on quality— producing, distributing, and supporting content that garners acclaim and box office at a smaller scale. Their ambitions are modest; they don't need to gross $200M per film or 7x their monthly subscribers.

In A24's case, the company's limited financial ambition has been one of its greatest assets, sheltering the studio from Wall Street and the allure of franchise filmmaking. Unfortunately, A24 has now raised significant capital from institutional investors, valuing itself at a reported $2.5B, which means it's no longer buffered from the revenue expectations other Hollywood studios face. Perhaps much of A24's remarkable ten-year run was a function of novelty and insulation from Wall Street pressures. Maybe people were this excited about Warner Brothers and Paramount when those studios first came on the scene—imagine hoards of Paramount enthusiasts lining up to buy Paramount-branded socks.

Worse yet, history is not on A24's side. While the indie studio exists as an outlier in today's film landscape, its business model is nothing novel. The 1990s saw an influx of smaller indie production companies supporting a class of visionary filmmakers, with Harvey Weinstein's Miramax perhaps serving as the most prominent example of these boutique outfits. These companies worked on small budgets, gaining clout via a handful of crossover hits like Pulp Fiction, Swingers, and Boyz in the Hood. Over time, legacy Hollywood studios slowly absorbed these production companies, with Weinstein's Miramax eventually selling to Disney. Most of these (formerly) indie subsidiaries were either disbanded by their corporate overlords or operate as a mere shadow of their former selves.

My best guess is that A24 will eventually be acquired by a major studio that will grossly overpay for the company's brand (and, in turn, their merch). Assuming A24 cannot resist an extravagant payday, they will likely go the way of Miramax and be subsumed by a multinational media conglomerate, losing their edge and becoming a distant memory as a once-fascinating business school case study.

That said, I hope I'm wrong. I hope A24 maintains its independence, doubling down on its niche, and producing even more offbeat gems like The Disaster Artist, Eighth Grade, and The Farewell. I hope A24 proves a shining example of iconoclastic commercial success, inspiring imitators and birthing a new generation of artistically-minded indie outfits. And, above all, I hope A24 continues to "do God's work"—and that God enjoys low- to mid-budget auteur-driven cinema.

Thanks for reading Stat Significant! Subscribe for free to receive new posts and support my work.

Want to chat about data and statistics? Have an interesting data project? Just want to say hi? Email [email protected]